Once the TDS Return is successfully filed, a provisional receipt is provided. Information on the receipt is important for filing the next Return and should be downloaded and stored in the system.

This is a function in the Income Tax Portal. Integration from within the software has been done to directly access the Income Tax Portal for making such payments. A special multi-purpose utility ‘PDSConnection1.0’ has been developed by us for the purpose of connecting and accessing the Portal for different TDS / TCS functions including the online deposit (payment) of TDS / TCS.

To activate this function, following needs to be done before this module can be used:

- Download and install the utility ‘PDSConnection1.0’ – this is a onetime action (till a new version is not available)

- The utility needs to be running in the background (just click on the utility icon)

It is presumed, that the above has been duly taken care of.

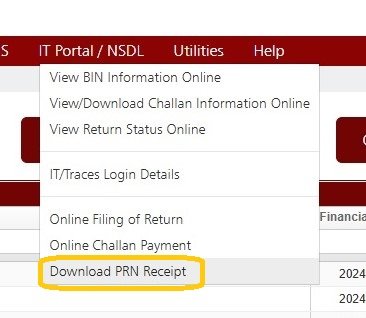

In order to Download PRN Receipt , click on ‘IT Portal / NSDL’ > ‘Download PRN Receipt’ :-

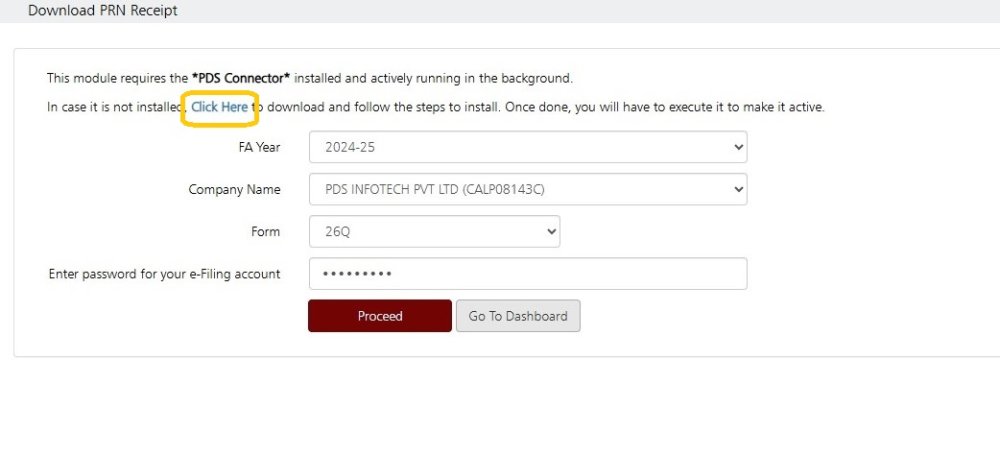

The following screen will get displayed:

If this utility is already installed the click on ‘Proceed’ .

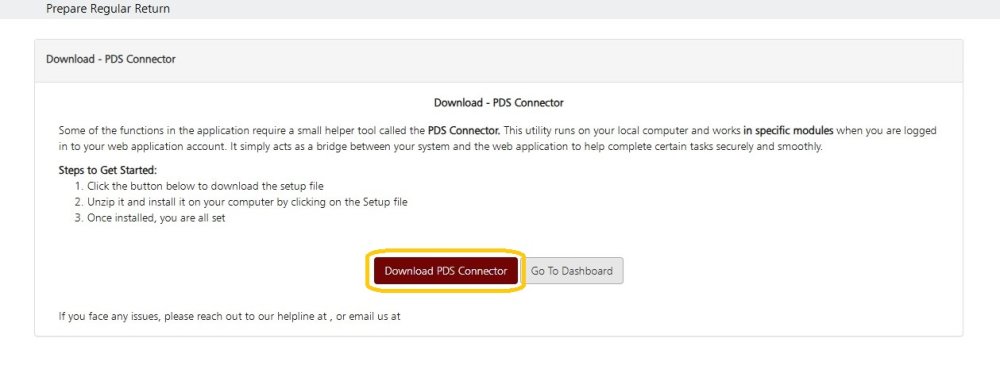

Click on ‘Click Here’ to download the ‘PDS Connector’ utility. The following screen will get displayed:

Click on ‘Download PDS Connector’ and install this utility.

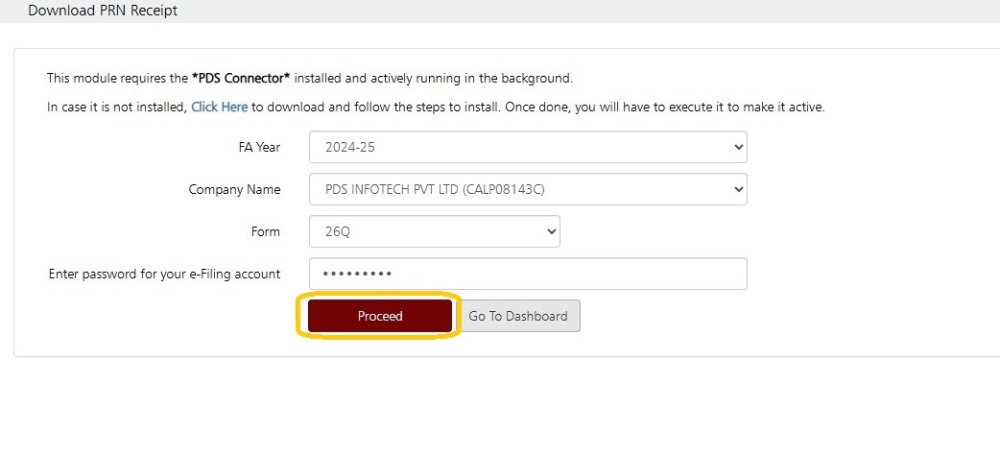

Once done, go to the previous screen , the following screen will get displayed:

Click on ‘Proceed’ .

The following screen will get displayed:

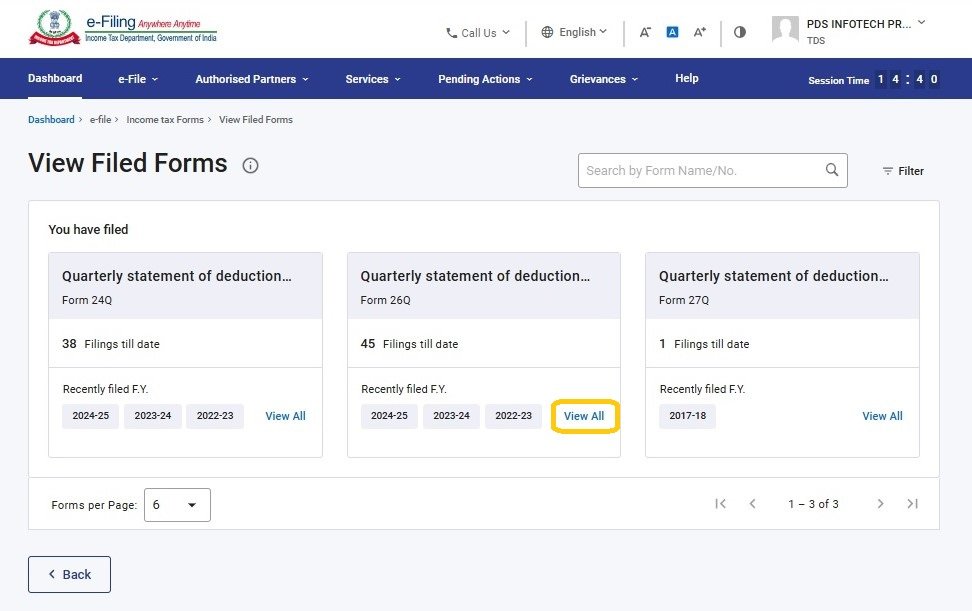

All the filings done till date, will get displayed. The required data can be selected. Click on ‘View All’.

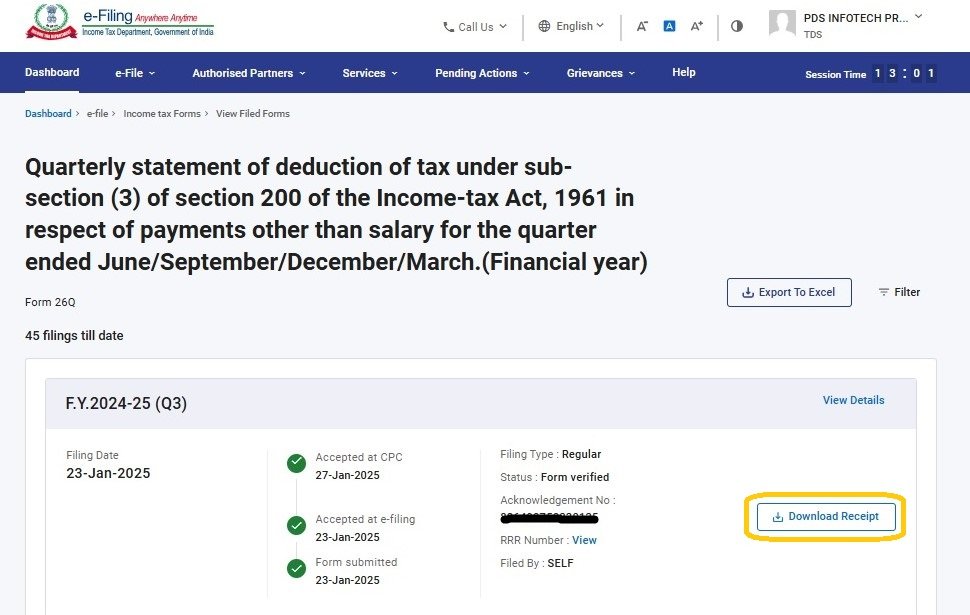

The following screen will get displayed:

Click on ‘Download Receipt’

Need more help with this?

CA-TDSMAN - Support